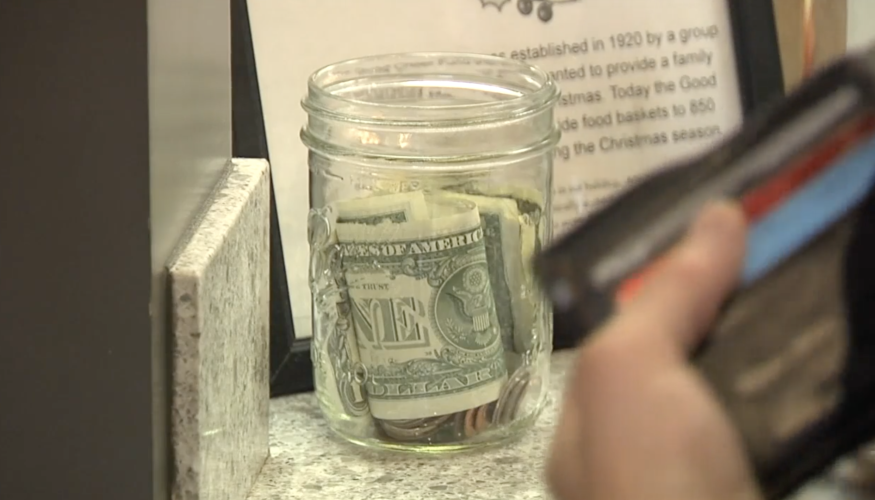

MADISON, Wis. — Wisconsin Republicans are resuming work on legislation to eliminate the state’s income tax on tips.

Progress on the bill, which was introduced in February, slowed as lawmakers waited for federal Congress to pass President Donald Trump’s so-called “Big Beautiful Bill,” which included a measure to allow workers to deduct up to $25,000 in tips on their federal tax returns.

Now, state lawmakers have reworked the legislation to mirror the federal bill. In its current form, the bill would create a $25,000 state income tax deduction for tips.

Watch: Wisconsin Republicans resume work on 'no tax on tips' bill

“We don’t want these tip earners to have to navigate a more complex tax system than they already have,” Rep. Ron Tusler, the bill’s co-author, said at a committee hearing on Thursday.

Democratic Gov. Tony Evers included a similar proposal in his budget draft earlier this year, but legislative Democrats haven’t signed onto the GOP-backed bill.

The state Department of Revenue estimates that the tax breaks would put nearly $34 million back into workers’ pockets each year. The bill is supported by the Wisconsin Restaurant Association and Wisconsin Hotel and Lodging Association.

It’s about time to watch on your time. Stream local news and weather 24/7 by searching for “TMJ4” on your device.

Available for download on Roku, Apple TV, Amazon Fire TV, and more.