The debate over who benefited the most from a tax cut supported by Senator Ron Johnson is already a big issue in the 2022 election.

In 2017, Republican Sen. Johnson pushed to include a tax cut under President Donald Trump for what's called "pass-through companies."

They are not subject to corporate taxes and instead pass through businesses report their income on individual tax returns.

Democrats have criticized the tax cut from day one.

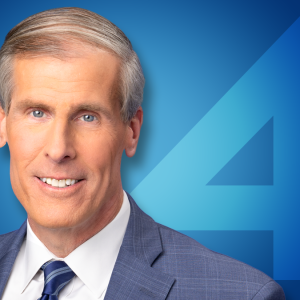

"We're looking here at a claim from the state Democratic Party that the tax carve out Sen. Johnson spearheaded overwhelmingly benefited the wealthiest over small businesses, " said Greg Borowski

PolitiFact Wisconsin says many small businesses are set as pass-through companies, but so are other businesses, including one Johnson was involved at the time.

So who benefited the most? PolitiFact Wisconsin says the numbers show most of the benefit went to the wealthy and not the small mom and pop businesses.

"In fact, in an April 2021 study from the National Bureau of Economic Research, which is part of the Treasury Department, under the top 1% of Americans by income received nearly 60% of the tax savings created by the provision,"said Borowski. "And most of that amount went to the top 0.1%."

Johnson has previously said any broad based tax cut will generally benefit those who make more and pay more.

PolitiFact Wisconsin said the dollar amounts definitely favored those at the top

"Even if you look at the top 10% of those getting the cut, they received $12 billion in total, while the other 90% got half of that about $6 billion." Borowski said.

PolitiFact Wisconsin rated the Democratic Party's claim True.